Web Application Ready

CHARM Platform offers a robust API service that integrates directly into your existing web applications.

AI/ML powered software platform built for SMB lenders. Continuous self-learning analytic models transforming financial data into actionable insights.

Schedule a Demo

.png)

This partnership will enable Abrigo’s clients to better manage their SMB portfolios, identify risk, and increase their efficiency and profitability. By using CHARM Platform's machine learning and scoring, acquisition teams can identify which SMB leads are most likely to convert, allowing them to focus on the most promising leads, while portfolio management can use the scores to identify which SMB customers need additional account management or other services. Additionally, the scores can be used to identify trends in customer behavior, allowing the company to better understand its customer base and tailor products and services accordingly.

Read about our partnership

CHARM Platform offers a robust API service that integrates directly into your existing web applications.

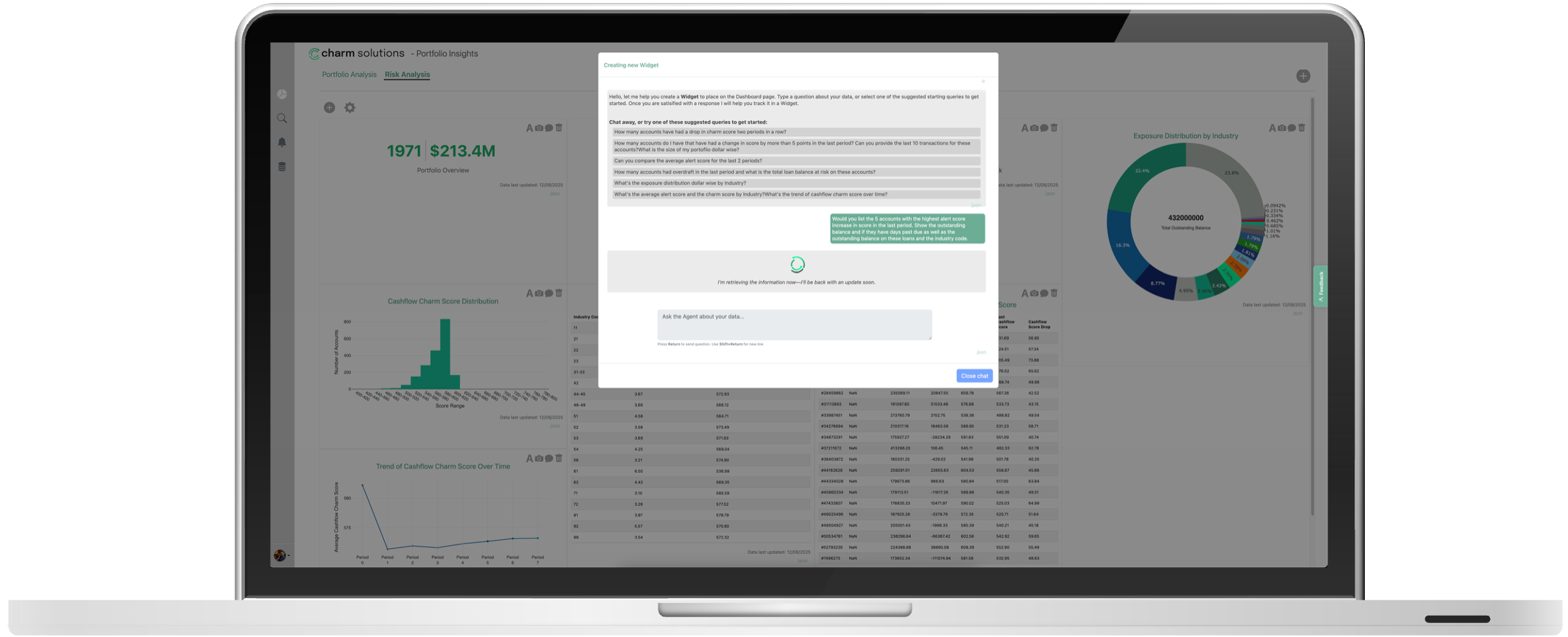

CHARM AI powered widgets embed directly into your current financial applications, enabling access to key features and insights into your customer's financial health.

CHARM SMBEngageTM Agent connects to a bank's SMB data for increased engagement.

SMBScore is built from decades of SMB accounting data from over six countries, utilizing proprietary ML technology.

AI-driven underwriting process optimization improves accuracy from our three intelligence pillars of data sets.

Continuous tracking and monitoring of default probability utilizing a borrowers' account behavior and patterns.

Analyze your deposit portfolio for qualifying SMBs for new financial product offers.

Leverage CHARM Platform to provide valuable insights to determine financial health, optimize operations, and make strategic decisions to drive growth.

It became clear to us that the SMB lending process was hindered by out-dated technology, business models that haven't evolved in a decade, and a disregard for a wealth of data telemetry. As a result, business owners were left with limited and unsatisfactory options, so we decided to do something about it.

At the outset of our journey, we dove headfirst into technology by creating databases that tracks the success of small business loans over the span of 30 years. By mining this massive database, which contains the past financial statements of millions of SMBs across the globe, we can identify the most important metrics for evaluating their creditworthiness.

Charm Solutions aims to revolutionize the lending process by leveraging the power of data to provide analytics, actionable insights, streamlined decisioning, and a commitment to helping businesses prosper.

Small business lending reimagined with AI-powered solutions.